Wealth Management

At its highest level, wealth management is simple. All it takes are these essentials:

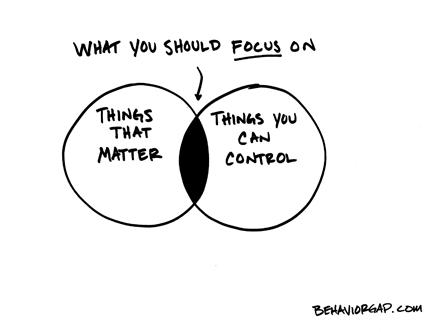

- A personal focus on what’s truly important to you – and what you can realistically do about it.

- A financial focus that integrates who you are with what you’ve got.

Jennings Financial Planning is your guide. For most of us, achieving this level of supreme simplicity is much harder than it appears. With preparation, process and practice, we bring you the focus you need. It's all geared to moving you past the complexities into a serene place where good decisions become easier--where your goals and your realities unite.

The journey encompasses exploring and addressing these five elements in your financial sphere:

- Enhancing wealth – with sound investing based on your personal goals. Learn more about our investment consulting process and philosophy.

- Protecting wealth – against life’s most likely uncertainties that could knock you significantly off-course. Your financial goals can span a lifetime, or even generations, so it’s important to prepare for uncertainty and events that could derail your overall strategy. Our role as your advisor is to not only assist you in defining your long-term objectives, but to help identify potential threats to your success, and ways you might be able to implement protection against them.

- Aligning wealth - with your values and goals through the various phases of your financial life. As you transition from building wealth to letting it serve you and those you love, we assist with deploying appropriate "decumulation" or "spend down" strategies aimed at improving the probability that your financial independence will be sustainable.

- Transferring wealth – preparing for a successful transition of your desired legacy. Part of that often depends upon good communication among family members. It also involves careful planning and employing sound legal strategies. Our practice has resources in place to assist in the process of ensuring that estate planning details are well-prepared and clearly defined.

- Donating wealth – defining and accounting for your charitable intents. There are many considerations and benefits when integrating philanthropic wishes into a wealth strategy. Charitable giving can play a significant role in your tax and wealth planning efforts. As part of our partnership, we can work with you to carefully integrate it into your personal strategy.

Let's talk about investing ...